VAT Simplified: What Small Businesses Get Wrong

- Robert Mabon

- Nov 14, 2025

- 6 min read

You're staring at another VAT return form, and that familiar knot forms in your stomach. The boxes seem to mock you with their cryptic numbers, and you're second-guessing every figure you've entered. Sound familiar? You're not alone, VAT trips up thousands of small business owners every quarter, and the mistakes can be costly.

The good news? Most VAT errors aren't because the system is impossibly complex. They happen because of a few common misconceptions and simple oversights that are entirely fixable once you know what to look for.

The Registration Timing Trap That Catches Everyone

Here's where most small businesses stumble right out of the gate: registering for VAT at completely the wrong time. You might think this sounds straightforward, but there's a sweet spot that many miss entirely.

Register too early, and you're suddenly charging an extra 20% on top of your prices, not exactly helpful when you're trying to compete with non-VAT registered competitors. Register too late, and you'll face HMRC penalties while missing out on claiming VAT back on all those startup costs you've already paid.

The magic number is £90,000 in taxable turnover over any rolling 12-month period. But here's what catches people off guard: you need to register within 30 days of crossing that threshold, not at the end of your financial year.

What you can do right now: Set up a simple spreadsheet to track your cumulative turnover each month. When you hit around £75,000, start preparing for registration. This gives you breathing room and ensures you don't miss that crucial deadline.

The Great Scheme Mix-Up (And Why It Matters More Than You Think)

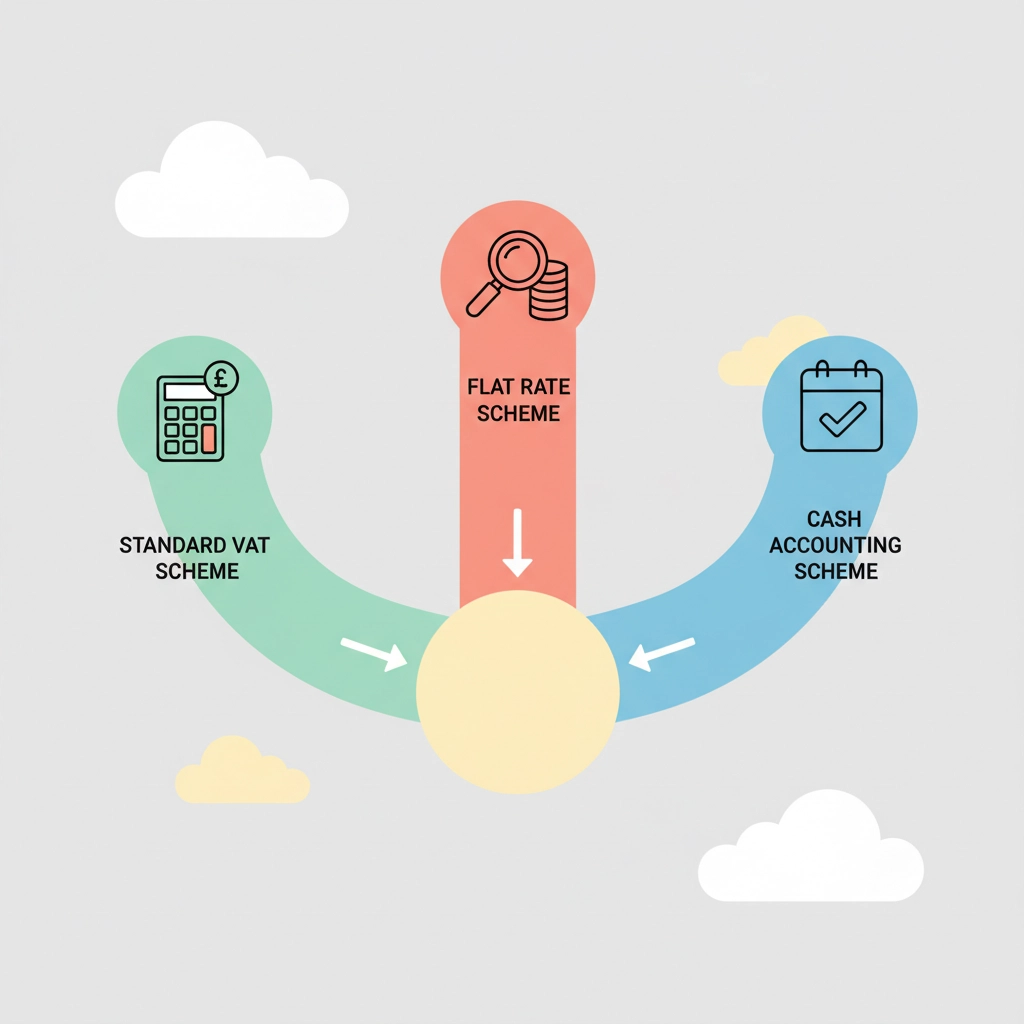

This is where things get interesting, and where many businesses leave money on the table. HMRC offers three main VAT schemes, and choosing the wrong one can cost you hundreds or even thousands of pounds each year.

Most people default to the Standard VAT scheme because it sounds, well, standard. But if your turnover is under £150,000, the Flat Rate Scheme might save you significant time and potentially money. Instead of calculating input and output VAT on every single transaction, you simply pay a fixed percentage of your gross turnover.

For example, if you're a consultant on the 14.5% flat rate, you'd pay £145 VAT on £1,000 of gross income, regardless of how much VAT you actually charged clients. Simple, right?

The Cash Accounting Scheme is another option that lets you account for VAT based on when you actually receive payment, not when you issue invoices. This can be a lifesaver for cash flow if you have customers who pay slowly.

The reality check: Most businesses never review their VAT scheme after initial registration. Take 10 minutes to calculate what you'd pay under different schemes, you might be surprised by the results.

Zero-Rated vs VAT-Exempt: The Confusion That Costs Money

This distinction trips up even experienced business owners, and it's crucial because the difference affects whether you can claim VAT back on your business expenses.

Zero-rated supplies (like most food, children's clothes, and books) are still VAT transactions, they just happen to be charged at 0%. Critically, you can still recover input VAT on your business purchases.

VAT-exempt supplies (like insurance, education, and banking services) aren't VAT transactions at all. If you provide exempt supplies, you generally can't recover input VAT on related expenses.

Here's a real example: a café selling takeaway sandwiches (zero-rated) can claim back VAT on ingredients, equipment, and utilities. But if they also offer cookery classes (exempt education), the VAT on expenses related to those classes can't be recovered.

Watch out for: Many businesses selling a mix of zero-rated and exempt goods get this wrong on their returns, leading to over or underpayments that create headaches down the line.

Box 6: The Return Field That Breaks Hearts (And Banks)

If there's one place where VAT returns go wrong most often, it's Box 6, the total value of sales and all other outputs. This innocent-looking box has probably caused more business owners sleepless nights than any other part of the VAT system.

The confusion comes from which scheme you're using:

Flat Rate Scheme: Box 6 should show your gross income (including VAT)

Standard or Cash Accounting Scheme: Box 6 should show net income (excluding VAT)

Get this wrong, and your return won't balance. HMRC might query your submission, and you'll spend hours figuring out where you went astray.

Your sanity-saving tip: Before submitting any return, double-check that Box 1 (VAT due on sales) makes sense compared to Box 6. If you're on the Flat Rate Scheme, Box 1 should be your flat rate percentage of Box 6. If the numbers don't add up, stop and investigate.

The Expense Claiming Minefield

You've probably heard that registering for VAT means you can claim back VAT on business expenses. That's true, with some important caveats that catch many people out.

You can't claim VAT on:

Business entertaining (except for staff parties under certain limits)

Expenses with a significant private use element

Zero-rated or VAT-exempt purchases (there's no VAT to claim back)

Some imports and purchases from overseas suppliers

The private use rule is particularly tricky. That laptop you use 80% for business and 20% for personal use? You can only claim back 80% of the VAT. Many businesses claim 100% and end up in trouble during HMRC inspections.

Overseas complications: If you buy services from overseas suppliers (think software subscriptions from US companies), you might need to apply the reverse charge procedure. This means accounting for both output VAT (as if you'd charged yourself) and input VAT (as if you'd paid it) on the same transaction.

The Cash Flow Reality Nobody Talks About

Here's something that catches many new VAT-registered businesses completely off guard: you need to physically set aside money for your VAT bill every quarter. It sounds obvious, but when that first £2,000 VAT bill lands and you've already spent the money, reality hits hard.

Unlike income tax, which might be deducted automatically from employee salaries, VAT is money you collect on behalf of HMRC. It was never really yours to begin with, you're essentially acting as an unpaid tax collector.

The practical approach: Open a separate savings account specifically for VAT. Every time you invoice a customer or make a sale, immediately transfer the VAT portion to this account. When your quarterly return is due, the money is sitting there waiting.

Filing Deadlines: The Expensive Mistake

HMRC doesn't mess around with VAT deadlines. Submit your return or payment even one day late, and you'll face automatic penalties. Miss multiple deadlines, and the penalties escalate quickly.

Your VAT return must be submitted online by the end of the month following your VAT period. So if your VAT quarter ends on 31st March, your return is due by 30th April. Payment must clear HMRC's account by the same date, not just be sent on that date.

The buffer strategy: Set your own internal deadline a week before the official one. This gives you breathing room if something goes wrong with your online submission or bank transfer.

The Profitability Myth That Holds Businesses Back

Many small business owners resist VAT registration because they worry it will make them less competitive or reduce profitability. This fear often stems from a fundamental misunderstanding of how VAT works.

If you're selling to other VAT-registered businesses, your VAT doesn't add to their costs, they can claim it back. For consumer sales, yes, you're charging more, but you're also claiming back VAT on your business expenses, which reduces your costs.

Consider this example: a web designer buys a £1,200 laptop (£1,000 + £200 VAT). Without VAT registration, that laptop costs £1,200. With VAT registration, they claim back the £200 VAT, so the laptop effectively costs £1,000.

The key is understanding your customer base and running the numbers for your specific situation.

Getting Back on Track

If you recognize your business in any of these scenarios, don't panic. Most VAT mistakes can be corrected, and HMRC is generally reasonable if you proactively identify and fix errors.

For significant errors in past returns, you can make voluntary disclosures to HMRC. For smaller errors (under £10,000), you can often correct them on your next VAT return.

The most important step is getting your systems right going forward. Whether that means choosing a different VAT scheme, improving your record-keeping, or simply understanding the rules better, small changes can save you significant money and stress.

Remember, VAT compliance doesn't have to be a solo struggle. If you're finding it overwhelming, getting professional help is often more cost-effective than making expensive mistakes. Sometimes the best business decision is recognizing when you need support: and there's no shame in that.

Your business deserves to thrive without the constant worry of VAT complications hanging over every decision you make.

Comments